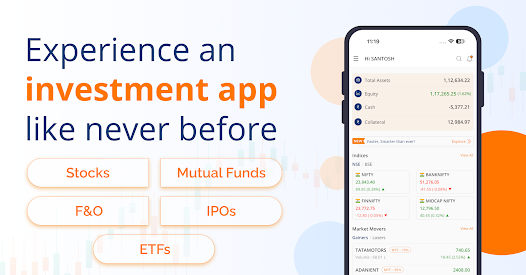

Once upon a time, investing in shares meant calling your broker, waiting for confirmation slips, and checking the newspaper the next morning for prices. Now, it’s all right in your hand. A single stock market app can show you live market data, let you place trades instantly, and track your portfolio anytime you want.

- Why apps matter today?

The market doesn’t wait. Prices move in seconds. In the past, small investors often missed opportunities because they didn’t have fast access. But with trading apps India, things have shifted. Students, working professionals, even homemakers, anyone with a smartphone and curiosity can now take part. A good app breaks down complicated charts, explains terms in plain words, and makes sure you don’t feel lost while making your first trade.

- The rise of online share trading

Think about how shopping moved online; the same thing has happened with investments. Online share trading is now the default for most. You don’t have to walk into an office or wait on a phone line. You log in, check prices, make a decision, and within seconds, your order is placed. That speed is important. But more than speed, apps give control. You see exactly what’s happening with your money, in real time. And that makes investing feel less like gambling and more like planning.

- IPO investments made simple

For many young investors, IPOs feel like a golden ticket, a chance to buy into a company before it becomes a household name. In the past, applying for an IPO meant filling out physical forms and hoping your bid went through. Now, IPO investments are possible in just a few taps.

Apps guide you step by step — how much to invest, what the cut-off price means, and when allotments happen. Even if you don’t get shares, refunds are quick, usually back in your account within days.

- Stock trading is not just for experts

The image of stock trading used to be intimidating: fast-talking brokers on phones, TV screens with flashing numbers, pressure at every corner. But modern apps are breaking that stereotype.

Stock trading today can be done calmly, even while sipping chai at your desk. You don’t need to start big. Many apps allow you to buy fractional shares or start with as little as a few hundred rupees. And because you can monitor performance live, mistakes become lessons rather than disasters.

- What to look for in an app

If you’re just starting out, choosing the right platform makes all the difference. A strong stock market app should offer:

- Ease of use: navigation should be smooth, even for beginners.

- Security: strong encryption and trusted brokers backing the app.

- Research tools: real-time charts, company news, analyst ratings.

- Low costs: hidden fees can eat into profits; transparency is key.

- Seamless IPO access: applying should be just as easy as placing a trade.

These features not only make trading easier but also build your confidence as an investor.

- The bigger picture

Technology has opened the doors of the market to millions. What was once exclusive now feels accessible. You can experiment, learn, fail small, and succeed gradually — all within the ecosystem of trading apps in India.

And that matters. Because financial growth doesn’t happen overnight. It’s about consistent learning, steady planning, and having the right tools to support your journey.