Online mutual fund investment has become a structured approach for individuals who want to plan their financial future around specific life goals. Rather than investing without direction, this method allows investors to align savings with defined objectives such as education planning, asset creation, or retirement preparation. With digital access, monitoring and managing investments has become more organised and transparent.

Many investors now prefer to Invest in SIP as part of their online mutual fund investment strategy because it encourages regular saving and long term discipline. Tools such as a Sip Calculator further help investors estimate potential outcomes and plan contributions according to their goals.

Understanding Online Mutual Fund Investment

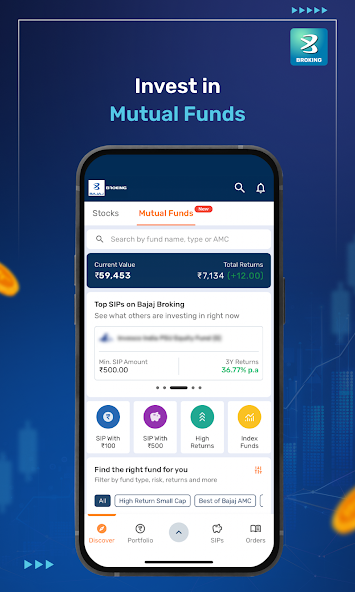

Online mutual fund investment refers to the process of purchasing, tracking, and managing mutual fund units through digital platforms. This approach removes paperwork, reduces delays, and allows investors to access fund information at any time.

Instead of relying on offline processes, investors can now view fund details, performance history, and portfolio allocation online. This accessibility helps in making informed decisions based on financial objectives rather than short term trends.

Goal Based Growth and Its Importance

Goal based growth focuses on matching investments with specific financial needs. Each goal has a time frame, cost estimate, and risk tolerance. Online mutual fund investment supports this approach by allowing flexibility in choosing funds that suit different horizons.

Common financial goals include:

- Building a long term savings corpus

- Planning for children’s education

- Creating a retirement fund

- Managing medium term expenses

When investments are aligned with goals, tracking progress becomes easier and decision making stays structured.

Role of SIP in Online Mutual Fund Investment

Systematic investment planning plays a central role in goal based investing. Many investors choose to Invest in SIP because it spreads investment over time rather than relying on a single contribution.

Key advantages of SIP-based investing include:

- Regular contributions that suit monthly income patterns

- Reduced impact of market timing

- Gradual accumulation of units

- Better alignment with long term goals

Online mutual fund investment platforms allow investors to start, pause, or modify SIP contributions easily, which adds flexibility to financial planning.

Using a Sip Calculator for Planning

A Sip Calculator is an essential planning tool for investors who want clarity on future outcomes. By entering the investment amount, duration, and expected return range, investors can estimate how their contributions may grow over time.

Benefits of using a Sip Calculator include:

- Setting realistic financial targets

- Adjusting contribution amounts based on goals

- Comparing different investment durations

- Improving discipline through measurable planning

Using a Sip Calculator before deciding to Invest in SIP helps investors align expectations with financial capacity.

Selecting Mutual Funds for Goal Alignment

Choosing the right mutual fund is critical for goal based growth. Online mutual fund investment allows investors to compare funds based on risk level, time horizon, and investment objective.

Factors to consider while selecting funds:

Time Horizon

Short, medium, and long term goals require different investment approaches. Long term goals generally allow for higher exposure to growth oriented funds, while shorter goals may focus on stability.

Risk Tolerance

Every investor has a different ability to handle fluctuations. Online tools help assess risk levels and choose funds accordingly.

Consistency of Performance

Rather than focusing on short term results, reviewing long term consistency helps maintain goal alignment.

Managing Risk Through Diversification

Diversification plays an important role in online mutual fund investment. Spreading investments across different asset categories reduces dependency on a single source of return.

Benefits of diversification include:

- Reduced portfolio volatility

- Balanced exposure across sectors

- Improved stability over long periods

Goal based growth becomes more predictable when investments are not concentrated in one area.

Monitoring and Reviewing Investments Online

One of the key advantages of online mutual fund investment is the ability to monitor progress regularly. Investors can review fund performance, check SIP status, and adjust allocations if goals or income levels change.

Periodic review helps in:

- Staying aligned with financial objectives

- Adjusting SIP amounts as income grows

- Rebalancing investments when needed

Monitoring should focus on progress toward goals rather than reacting to short term market movements.

Tax Considerations in Mutual Fund Investing

Understanding taxation helps investors plan net returns more effectively. Online mutual fund investment platforms usually provide transaction records and statements that simplify tax planning.

Investors should consider:

- Holding period impact on taxation

- Use of tax saving fund options for eligible goals

- Long term planning to improve post-tax outcomes

Clear tax awareness supports better decision making without altering investment discipline.

Common Mistakes to Avoid

While online mutual fund investment offers convenience, some common mistakes can affect goal based growth.

Mistakes to avoid include:

- Changing investments frequently without reviewing goals

- Ignoring risk suitability

- Not reviewing SIP amounts periodically

- Investing without using planning tools

Using a Sip Calculator and committing to Invest in SIP with discipline helps reduce these issues.

Building Financial Discipline Through Online Investing

Consistency is the foundation of successful investing. Online mutual fund investment encourages structured saving habits by automating contributions and tracking progress digitally.

Over time, disciplined investing supports:

- Better financial awareness

- Reduced emotional decisions

- Steady progress toward goals

Digital access makes it easier to stay organised and committed to long term plans.

Conclusion

Online mutual fund investment offers a practical framework for goal based growth when combined with proper planning and discipline. Investors who invest in SIP benefit from regular contributions that support long term objectives without the pressure of timing decisions. Using a Sip Calculator before and during the investment journey helps maintain realistic expectations and measurable progress.

By aligning funds with goals, reviewing performance periodically, and maintaining diversification, online mutual fund investment becomes a structured path toward financial stability. With consistency and clarity, investors can build a portfolio that supports both present needs and future aspirations.